In this week’s issue of the Principle 6 Newsletter, republished below, Mike Mercer envisions four “long games” the credit union movement could work toward achieving. One imagines credit unions being acknowledged as institutions dedicated to building wealth for Americans.

“Working together and committed to common benefit, credit unions could legitimately claim the role of champions for personal wealth creation,” Mercer writes. “People would come to learn that credit unions would really help them navigate life in ways that build family wealth. Credit unions make wealth creation contributions every day. But it happens mostly in discreet unconnected experiences—a better rate here, more favorable terms there.” What would it look like to be intentional about wealth creation?

Read the full issue of Principle 6 Newsletter below to find out. And while you’re thinking about “cooperation among cooperatives,” take a moment to consider how you and your cooperative practice this principle. NCBA CLUSA is on a mission to document Principle 6 collaborations across the country so we can identify trends, document best practices and share this knowledge with you—our fellow cooperators!

Share your example of Principle 6

Principle 6 Newsletter – What is the Long Game?

Issue 18 – March 24, 2021

Some fundamental changes occur in a maturing industry’s competitive environment… Michael Porter identified these changes as follows:

- Growth in buyer demand slows down. This generates head-to-head competition for market share.

- Buyers become more sophisticated. They start hard bargaining on repeat purchases.

- Competition produces a greater emphasis on cost and service. All competitors try to reduce costs and improve services to customers.

- The industry experiences a slowdown in capacity expansion because of slow growth.

- It becomes difficult for the producers to create new product innovations, and eventually, they may not be able to sustain buyer excitement.

- International competition increases because growth-minded companies try to find out ways to enter into foreign markets.

- Industry profitability falls temporarily or permanently. This happens due to slower growth, increased competition, and occasional periods of overcapacity.

- Competition becomes very stiff. As a result of this, competitors feel the urge to go for mergers or acquisitions rather than going for competition against each other. The resultant outcome is that the weak and inefficient firms are driven out of the industry.

– Michael Porter, “Strategies for a Maturing Industry,” Institute for Strategy & Competitiveness, iEduNote, website, 2021

“The greatest organizations play an infinite game. Tesla is an example of this. Elon Musk (at Tesla) is not playing to win by hampering the automotive competition. Where finite players play within boundaries, infinite players play with boundaries. In order for the infinite game to continue, it must constantly be changing. The worst thing that can happen is for the rules to become rigid. Infinite players bend and change rules for the purposes of continuous play.”

– Hadi Khatib, “Business is Based on Game Theory,” AMEinfo, 10-26-20

Many credit unions are growing. Most are still operating with positive bottom lines. Consumers and consumer advocates still like credit unions. And, as we have been pointing out in this letter, credit unions are endowed with a superior business model for helping members succeed. Financial services may be a mature industry, but many credit unions are rockin’ and rollin’. No time to be screwing around with what works, it would seem. No need to talk about a long game. Constant improvement with the short game is working just fine!

Well…

Margins have been getting a tad thin. It was long ago that net interest income stopped covering operating expenses. We blamed low rates initially. But it’s looking more like competition will turn out to be the sustaining culprit. Efficiency and cost-cutting have been the response. Often, consolidation is regarded as the affordable way to scale. That’s because fast organic growth reduces the capital ratio, the true measure of growth capacity. In fact, looking at Michael Porter’s list above, one can’t help but wonder if credit unions will eventually be smothered as consumer finance takes on the characteristics of a mature industry.

So, what if we hired Elon Musk to paint credit unions a picture of the “long game”?

Better yet, what if we asked him to give us long game options for the entire group of credit unions? We call that the “movement” or “system” (sorry, CUs are not an industry). What could the long game look like for the credit union system?

Contemplate some possibilities:

5,000 Points of Light

In 1990, George Bush (41) announced a program he called “a thousand points of light.” Offered rewards for people/organizations doing creative good things. Credit unions could envision the strategic path to the future that way. 5,000 points of light! Turn individual entrepreneurship loose. Strong survive, weak become acquired by the strong. The 5,000 lights become 300 less every year. Outwardly, we showcase the brightest of the lights. Imply that the whole group is made up of the same stuff. To the public, “Open Your Eyes (to CUs)” becomes “See the Light!”

In many ways, American credit unions are on this path now. This end game vision would require some intentional packaging. Elon Musk might suggest that the “light” is genuine member centricity. He could assert that the cooperative business model is the fundamental enabler (that the competition couldn’t/wouldn’t replicate). And he would likely argue that the “brightness” of each light would be driven by the value being produced at each node. The official family (directors and management) would be largely free to chart their own course toward value creation, collaborating and consolidating where necessary to achieve the requisite capacity.

By the time Bush 41’s great granddaughter runs for president, there might be only 1,000 points of credit union light remaining. In the meantime, considerable effort will be necessary to protect the charter. Memberships will be increasingly concentrated in fewer large credit unions. Successful large credit unions would increasingly emulate and threaten the other financial service providers, making policy uniqueness harder to sustain. The story of “bright lights” could dim over time. Who remembers what became of 41’s points of light? Be honest, who even remembers that program at all? There would still be credit unions, but the “5,000 points of light” long game might develop credibility and sustainability problems.

Lords of Consumer and Community Finance

Even without the “lights,” U.S. credit unions are presently driven by 5,000 unique strategic plans. There are many thousands of independent brands, mostly shrouded in some degree of cooperative (or at least credit union) identity. Local domain growth is the disavowed but primary measure of success in most CU incentive systems. And, for the alpha credit unions, preeminence in the local market is the visual for the “long game.” Dominance in the small cities and rural counties. Maybe not dominance in the big cities, but a player with strong market share. As time progresses and circumstances unfold, preeminence in the local consumer financial services markets will be claimed by one (or a few) credit unions. For some, this may come to include small business financial services.

This long game envisions becoming the institution of choice in the market, among all of the other local financial institutions. The “premier” local financial services provider.

Aspiration extends beyond being the last credit union standing. This long game envisions becoming the institution of choice in the market, among all of the other local financial institutions. The “premier” local financial services provider. The other credit unions in town will not be spared the competitive attention of the would-be alpha credit union. Longstanding employer group relationships would be officially respected but routinely ignored in new business development activities. Darwin and Porter (individual success) replace Desjardins and Bergengren (common success) on the credenza.

A decade or so ago, folks understood how this would work. More and better branches. Unrivaled ties with employers and community leaders. In-person service with a smile, good prices and some occasional helpful advice. There were significant costs to switch relationships, institutions had control of knowledge. Geographic preeminence. Today, it’s not so clear. In the foreseeable future, the branches, local sponsorships and community ties still matter. But they impose a cost structure that can easily reach 3 percent of assets when individual accounts only average $10,000. Digital providers are coming to town with cost structures of 1 percent or less. Big online retailers will embed financial services next. And the big banks have gone online effectively. More important, consumers are now in control of knowledge. They go to their handheld devices for solutions and price comparisons. They can easily manage multiple relationships.

Not many of the 5,000 can succeed at this long game. The definition of convenience will change more in the next 10 years than it has in the last 40. The requisites for becoming dominant or preeminent could morph just as fast. Could this vision be a strategic mirage?

Champions of Personal Wealth Creation

Maybe the long game shouldn’t be about how much “light” credit unions shine with good deeds and product/service benefits—or how many will survive to become influential market participants. Elon Musk and others like him would ask “What are you doing to change lives?” In the case of credit unions, “How are you improving the lives of members?” Competitive strategists would quickly say that tackling something big isn’t the kind of thing that gets done alone. If Tesla is going to succeed, they need lots of people to switch from oil to electric propulsion soon. For that to happen, all the manufacturers and thousands of infrastructure providers need to redirect resources to electric. And for that to happen soon enough (for Tesla to survive), they need to share much of what they know, even with competitors. They’re making a new market, not trading market share.

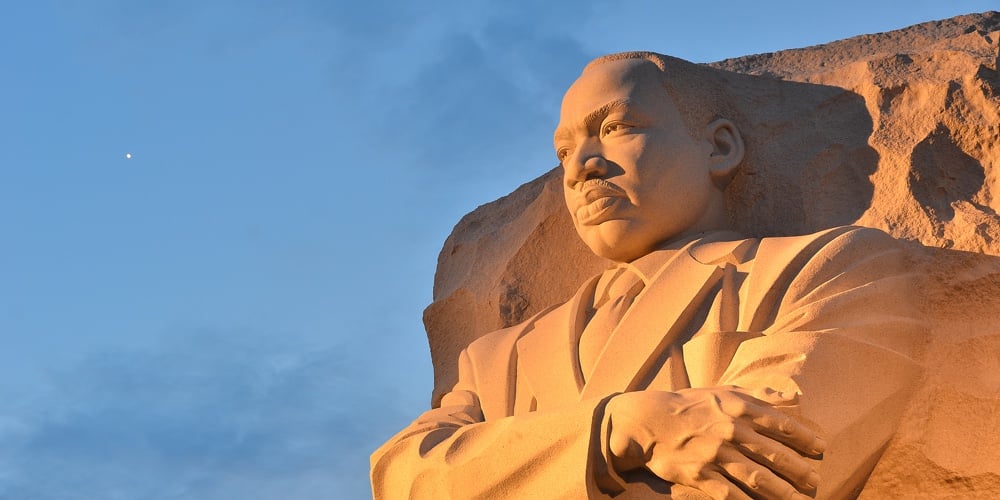

Imagine that the long game for credit unions (as a system) was to become acknowledged as the institutions that are dedicated to building wealth for American families.

Imagine that the long game for credit unions (as a system) was to become acknowledged as the institutions that are dedicated to building wealth for American families. Lots of companies have made that proclamation, especially among the investment firms. Consumers have learned to be on their guard. They know that their hard-earned money is just fodder for wealth extraction schemes cloaked in the pretense of helpfulness.

But, working together and committed to common benefit, credit unions could legitimately claim the role of champions for personal wealth creation. People would come to learn that credit unions would really help them navigate life in ways that build family wealth. Credit unions make wealth creation contributions every day. But it happens mostly in discreet unconnected experiences—a better rate here, more favorable terms there. The internal metrics are overwhelmingly focused on the firm; operational, financial, risk, sales, growth, and the like.

To succeed at becoming champions of personal wealth creation, the metrics would have to move out to the member. Not service utilization and delinquency but things like debt reduction, life-stage accomplishments and wealth accumulation measures. Baseline and review. Annual financial physical. Rewards for achieving individual plans. There would need to be expanded solution capabilities, presumably enabled by collaboration. The long game would start with a picture of the future. It should be bold and transformative. With a picture, reverse engineering could bring the to-do list back to the present.

Pillars of the Inclusive Civil Economy

Suppose the long game was something bigger, more profound than credit unions? Bigger even than some kind of co-op commonwealth? Remember, we’re flirting with Elon Musk thinking. The guy that envisions electric propulsion for all, knowing that his cars and batteries will play a foundational but not exclusive role. Credit unions could envision playing a foundational role in building a more inclusive economy for working folks. An economy where workers own their companies. Where residents own their buildings. Where neighbors own their food stores. Where family farmers supply those food stores. Where small businesses own their suppliers. Credit unions could be an oracle into this circular economy for their 120 million members.

Capitalism rapidly concentrates wealth and power. Happened in the late 1800s. Happening again now. Government concentrates political power and redistributes wealth. Capitalism is needed to fuel growth and government is necessary to avoid insurrection. But there is room for a third option… a civil economy. An engine of economic activity that spreads wealth without divorcing reward from contribution. Not capitalism, not (state directed) socialism. Cooperatives are among the organizations that marry entrepreneurship with inclusion and fairness. Where the well-being of those being served moves to the front of the line, ahead of short-term profit. Credit unions are cooperatives, with democratic governance systems.

Credit unions could lead in the development of a third economic rail in the US… a civil economy.

Credit unions could lead in the development of a third economic rail in the US… a civil economy. Part of the new order of things, not a replacement for private capital ownership or public sector (tax-funded) functions. The civil economy could be another option. One that would be attractive to many folks in our society. A civil economy could strengthen the so-called middle class, not weaken it through wealth concentration or income redistribution. It would take transformative leadership to create this possibility. It would require significant strategic alignment and new forms of collaboration. But it would also place credit unions where the present-day competition could never go.

So, these are just four end-game possibilities. There are others, perhaps many others. And some are more plausible than others. Certainly, some require more collaboration than others. None completely right, none completely wrong. But the obligation for system leaders is to openly contemplate the possibilities in relentless pursuit of opportunity. Leading is largely about painting pictures of aspiration for the future. No better time than the present to start painting!

Will we work alone or together?

Stay tuned,

Mike