This week, we’re amplifying the second newsletter in a series published by Mike Mercer, former President and CEO of Georgia Credit Union Affiliates and a 2020 inductee to the Cooperative Hall of Fame. In this issue of the Principle 6 Newsletter, republished with permission below, Mike reflects on the credit union journey, from small, self-help organizations in the early 20th century to an industry with more than 120 million members today.

As “rapidly changing consumer expectations, external competitive pressures and pragmatic decision-making within [credit unions]” change the face of the credit union movement, Mike considers whether credit unions will move “strategically toward or away from the cooperative business model in the years to come.”

Read the full issue of Principle 6 Newsletter below. And while you’re thinking about “cooperation among cooperatives,” take a moment to consider how you and your cooperative practice this principle. NCBA CLUSA is on a mission to document Principle 6 collaborations across the country so we can identify trends, document best practices and share this knowledge with you—our fellow cooperators!

Share your example of Principle 6

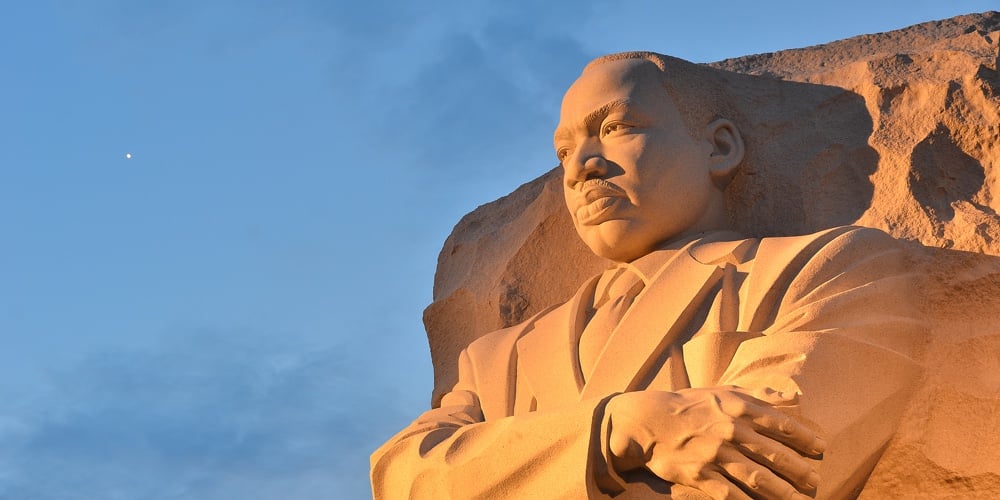

Principle 6 Newsletter – The CU Cooperative Journey

Issue 2 – July 29, 2020

A cooperative is an autonomous association of persons united voluntarily to meet their common economic, social, and cultural needs and aspirations through a jointly-owned and democratically-controlled enterprise. – International Cooperative Alliance, definition adopted in 1995

OK…

Stop ten credit union CEOs on the street, and ask them to define a “credit union.” You might hear something like, “…a financial institution, owned by its members, that provides banking services.” Or, if they’ve been subjected to standard CU indoctrination programs, “…a not-for-profit cooperative that provides financial services with the purpose of improving member well-being.” If your small sample includes a pragmatic cynic, you might be presented with, “…a bank with no stockholders and a tax exemption.”

Let’s back up for a minute… and assemble some context before diving into contemporary dialogue about credit unions and the cooperative business model.

Credit unions were born as co-ops. In the early 20th century, they were truly small self-help organizations, organized and operated by volunteers. Most credit unions have a page buried somewhere on their website that tells the story of a dozen folks who threw some coins into a cigar box. In the U.S., many credit unions were sponsored by an employer or local church.

Organized around democratic cooperative principles (initially learned from Quebecers), credit unions were created to solve for real needs of the time. Among them:

- A catalyst for systematic savings

- Access to affordable credit

- Low-cost employee benefit (for employers)

- Mobilization of worker savings (for Depression-era government policy)

Credit unions eventually came to be called a “movement.” They were promoted and proliferated by evangelists. Bergengren to begin with. Soon after, disciples appeared in many states. Then, Leagues, CUNA and CUNA Mutual organized the work of formation… and early nurturing. Some of us (picture Dick Ensweiler) are old enough to remember the Founders Club, where recognition went to those who started the most new credit unions every year.

Beginning in the 1970s, credit unions were guided increasingly by the hired guns. In time, the professionals propelled credit unions through deregulation, service expansion, consolidation, consumer disclosure rules, digital disruption and many other environmental changes. Beneath the waves, consumer needs/expectations were changing profoundly. And, with growing sophistication, credit unions ensconced themselves with a labyrinth of franchise protection advocacy capabilities… the ascendant role of the associations.

Along the way, membership exclusivity largely gave way to a posture of customer inclusivity. The idea of ‘place’ migrated from work to commuting paths to retail centers to the internet. For most credit unions, lending has evolved through paycheck-bridging to consumption goods to housing to commercial purposes. Brand identity was initially associated with sponsor organizations, but later became associated with locale and, more recently, with aspiration. Through all of this, the notions of mutuality and cooperation have mutated in countless ways.

Early credit union governance could be characterized with terms like “economic democracy,” “self-help” and “active member engagement.” Elections were by and from the members, often contested. Annual meetings were social events and dividends amounted to year-end profit-sharing. If the credit union ran into trouble, there were ‘scale-downs’ of shares and deposits. Members often thought of themselves as real owners.

In contemporary times, credit union governance religiously adheres to the one-member-per-vote foundation. But, in practice, credit unions are often run more akin to mutual organizations where member engagement is limited to service usage and net promoter surveys. Members are rarely discouraged from regarding themselves as customers. At the board level, institutional stewardship is heavily focused on the well-being of the firm… growth, earnings and risk tolerance. There are significant peer-convergence influences from all of the regulatory guardrails. And, competition (for relevance with consumers) is coming from everywhere.

Shreds of all of these philosophic, historic and competitive influences infiltrate the thinking of contemporary credit union leaders. The conceptualization of and the opportunities associated with the cooperative business model (as applied in the credit union experience) are buried under confusing signals and de-prioritized by the demands of the daily to-do list.

So, for you thought-framers…

- Credit unions were born as legitimate (and often vital) cooperative enterprises. Heritage firmly established!

- Credit unions are still solidly structured as co-ops, in most cases still relevant in the eyes of consumers and public opinion leaders.

- But, rapidly changing consumer expectations, external competitive pressures and pragmatic decision-making within have created the conditions for inflection.

Will credit union leaders move strategically toward or away from the cooperative business model in the years ahead?

Stay tuned…

And stay healthy.

Mike