NCBA CLUSA continues to closely monitor the global coronavirus (COVID-19) pandemic. As the situation evolves, NCBA CLUSA is referring to guidance provided by the Centers for Disease Control and Prevention and the World Health Organization to inform our operations in the U.S. and in the 21 countries around the world in which we implement development projects.

As cooperatives everywhere face the impacts of COVID-19 on their businesses and communities, we are making the following resources available as a service to our members and the co-op community. Many federal programs intended to provide COVID-19 disaster relief have closed. In the webinars and information below, you can access previously recorded webinars, get best practices on managing finances and cash flow during crises, find legal and risk management tips on navigating business interruptions, and more.

If you have additional resources you would like to share with the co-op community, or if you have questions about COVID-19’s impact on your co-op, don’t hesitate to reach out.

Please note: The information contained on this page is for informational purposes only. The purpose of this page is to promote understanding and knowledge of the COVID-19 pandemic and the potential effects on cooperative businesses. NCBA CLUSA is not providing advice on legal, health or public health issues. Consult the Centers for Disease Control and Prevention (CDC), World Health Organization (WHO) and federal and local authorities for more information related to public health. For legal advice, please consult with your attorney.

Hosted by the Cooperative Economists Council with support from CoBank and Nationwide, this webinar explores how co-ops are adapting in the face of shifting priorities.

Hosted by the Cooperative Economists Council with support from CoBank and Nationwide, this webinar explores how co-ops are adapting in the face of shifting priorities. A virtual briefing hosted by the Congressional Cooperative Business Caucus and presented by NCBA CLUSA in partnership with Growmark, the Federation of Southern Cooperatives/Land Assistance Fund and Organic Valley.

A virtual briefing hosted by the Congressional Cooperative Business Caucus and presented by NCBA CLUSA in partnership with Growmark, the Federation of Southern Cooperatives/Land Assistance Fund and Organic Valley. Hosted by NCBA CLUSA and the U.S. Small Business Administration, this webinar offers advice on navigating the application process for SBA’s Economic Injury Disaster Loans.

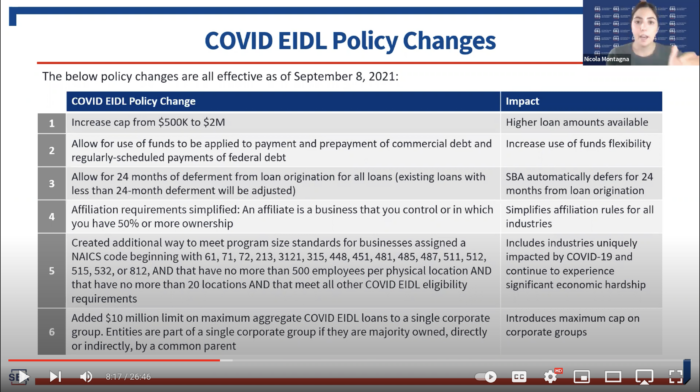

Hosted by NCBA CLUSA and the U.S. Small Business Administration, this webinar offers advice on navigating the application process for SBA’s Economic Injury Disaster Loans. NCBA CLUSA, law firm Dorsey and risk management leader Marsh provide advice on preparing your cooperative for potential business interruptions related to the coronavirus (COVID-19).

NCBA CLUSA, law firm Dorsey and risk management leader Marsh provide advice on preparing your cooperative for potential business interruptions related to the coronavirus (COVID-19).  Hosted by NCBA CLUSA and Shared Capital Cooperative, this webinar offers advice on navigating the financial challenges caused by COVID-19, addressing issues ranging from cash flow management to working with vendors and lenders.

Hosted by NCBA CLUSA and Shared Capital Cooperative, this webinar offers advice on navigating the financial challenges caused by COVID-19, addressing issues ranging from cash flow management to working with vendors and lenders. *This webinar was held before the application deadline of December 31, 2021*

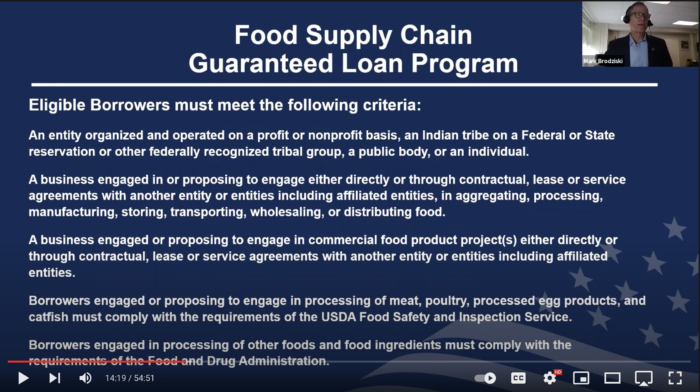

*This webinar was held before the application deadline of December 31, 2021* As part of the implementation of the American Rescue Plan Act, the U.S. Department of Agriculture (USDA) announced a new Food Supply Chain Guaranteed Loan Program to increase access to capital to build a stronger, more resilient food system. Eligible use of funds include but are not limited to startup or expanding activities related to aggregating, processing, manufacturing, storing, transporting or distributing food. Cooperatives are eligible to participate in this program and funds may be used in rural and urban areas.

As part of the implementation of the American Rescue Plan Act, the U.S. Department of Agriculture (USDA) announced a new Food Supply Chain Guaranteed Loan Program to increase access to capital to build a stronger, more resilient food system. Eligible use of funds include but are not limited to startup or expanding activities related to aggregating, processing, manufacturing, storing, transporting or distributing food. Cooperatives are eligible to participate in this program and funds may be used in rural and urban areas.