Are you wondering how to start a cooperative business or if a co-op is right for your business? There are a lot of steps to starting a cooperative and factors to consider throughout the process. We’re here to help you get started. In this guide to starting a cooperative, we’ll provide an overview of how to organize a co-op and what you can expect. If you determine the co-op model is the right fit, you’ll be ready to commit to a rewarding and empowering business venture.

What Is a Cooperative?

A cooperative is a form of corporation owned and controlled by its users. For example, a grocery co-op is owned by the people who shop there.

Cooperatives are open to anyone who is willing to accept the terms of membership. They are fully controlled by their members, and members equally contribute to the capital. The profits of the co-op are distributed among the members or reinvested in the company.

Equality is one of the core values and founding principles of a co-op. Members in a cooperative have an equal say. Unlike other types of corporations, where shareholders have more say if they own a higher percentage of the company, all co-op members follow the principle of “one member, one vote,” which carries equal weight.

A co-op will usually have a board of directors to run the business, set up policies and make sure everything stays on track. The members of the board are members of the cooperative and are usually elected by vote. The board of directors makes decisions based on the votes of regular members.

A cooperative can be created in any industry and can be any size. Cooperatives are commonly found in agriculture, grocery, healthcare, housing, financial services and utilities. Cooperative businesses continue to grow, and today, 1 in 3 Americans has joined a co-op.

Should Your Business Be a Co-Op?

If you’re interested in starting a new business or changing the structure of your current business, the co-op business model may be the answer. As with any business, you want to make sure the cooperative model suits your vision best before investing your time and money. Here are some reasons a cooperative might be right for you:

- Stability: Employee-owned businesses are less likely to reduce employment during a recession. This stability helps companies like cooperatives make it through economic challenges. Employee-owners also help increase profits.

- Democratic control: A co-op is run by its members rather than controlled by investors. With a co-op, no one has a greater say than any other person. One member, one vote.

- Lower startup costs: A cooperative may be an appealing option for those who require lower startup costs. With a cooperative business, every member contributes to the capital and provides support. Your business partners will be the people in it with you every day.

- Benefits to the community: Co-ops are an excellent option for individuals who want to serve their community. For example, co-ops may obtain products or services that would usually be unavailable in the community or would otherwise be unaffordable. Co-ops also contribute to the economy of the local community. Overall, the focus of a cooperative is to benefit its community, instead of delivering profit to investors.

- Worker engagement: Employees are more likely to be engaged with a company that they own and benefit from. They are also more likely to be committed to the quality of service and products they provide because they will want to see their company succeed.

- Tax advantages: Like other businesses, cooperatives face tax rules, but they can also reduce their tax burden in ways other corporations can’t. For example, a co-op can issue patronage dividends that can be deducted from its taxable income.

Like every good thing, the cooperative model has several disadvantages entrepreneurs should consider:

- Financing: Generally, cooperatives don’t attract large investors who want greater control of the company with more shares. It can also be tough for cooperatives to get loans from banks. However, that doesn’t mean financial assistance is unavailable for cooperatives. There are various funding opportunities to help co-ops get started, such as the Rural Cooperative Development Grant (RCDG) program, which supports co-op development through different organizations around the country.

- Longer decision-making process: Cooperatives require time to make decisions because all members are part of the decision-making process. If you anticipate the need to make decisions fast, a cooperative may not be the best option for your business.

- Reliance on members’ involvement: Co-ops depend on their members’ interest levels and involvement. If members lose interest in the co-op and stop investing energy in the business, it can affect the co-op’s growth and success.

- Profits are disbursed among members: A cooperative spreads its wealth among its members. Therefore, the founding members of a cooperative business do not benefit more than others only because they started the cooperative. This may make a co-op an unattractive option for some business owners.

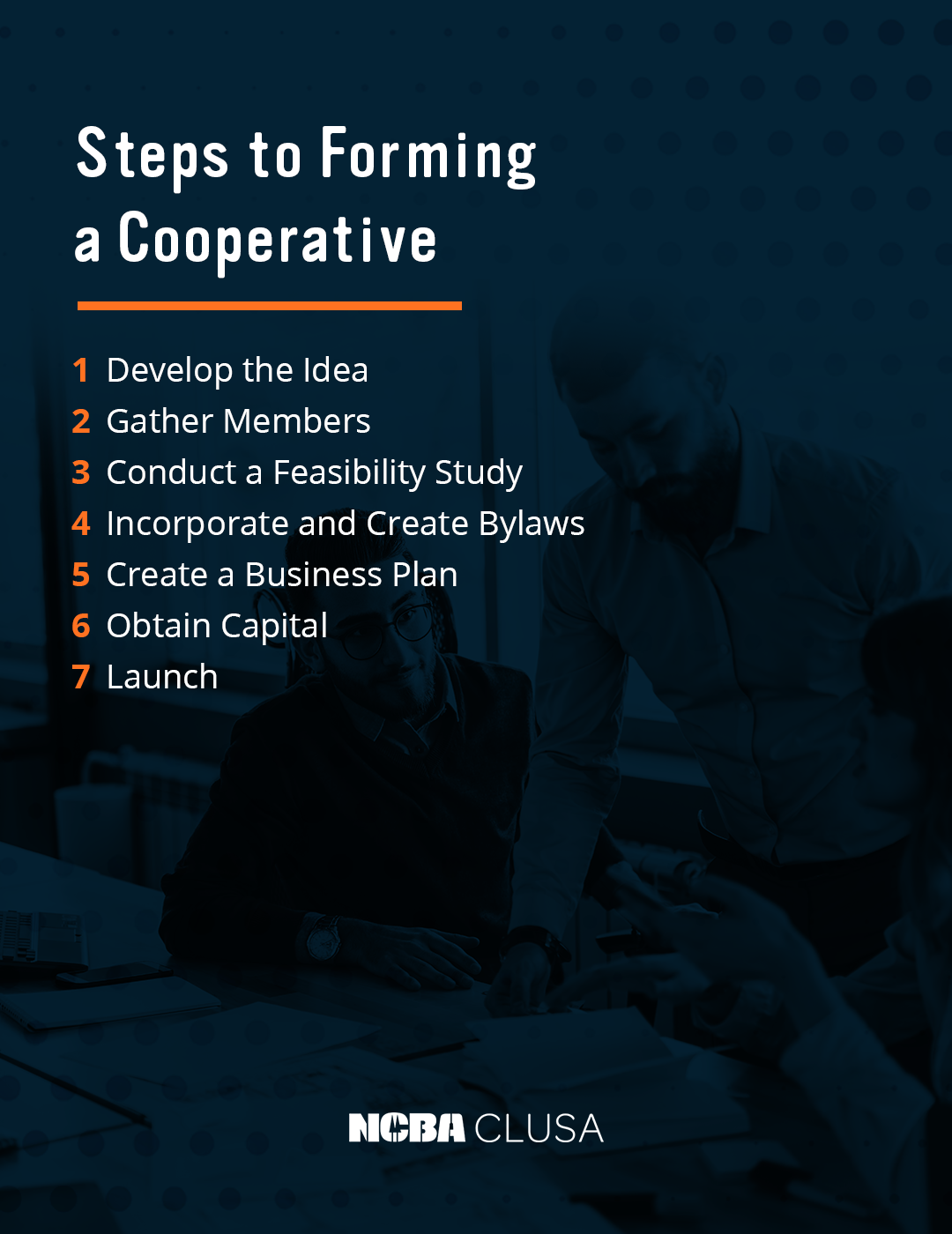

How to Form a Cooperative Business

Like any business, starting a cooperative business requires dedication and business know-how. If you are new to the business world, there are professionals out there to assist you throughout the process. Also, a cooperative is about its members, so you won’t be alone if you find people who want to join your mission and be part of your success.

Follow this step-by-step co-op startup guide to get an idea of what it takes to organize a co-op and where to start:

1. Develop the Idea

A cooperative is a business that needs to make a profit to continue operating. You first need to know what you are going to sell or what services you plan to provide. Consider your target customers and whether they will find the pricing of your product or services fair.

One way to develop a co-op idea is to identify something your community needs and how your business can fill that need. Are there certain products or services unavailable? Are some products of poor quality or overpriced? Research your community to determine if your idea will work. Plan to spend three to six months exploring your business idea.

2. Gather Members

You need to gather individuals who are genuinely interested in your business idea and who may want to become members of your cooperative. Hold a meeting with potential members and develop your mission and core values. Clearly define your business idea and describe how it’ll benefit the lives of the co-op members. Also, during the meeting, choose the name of the co-op and its head office location.

3. Conduct a Feasibility Study

A feasibility study will help you determine if your idea is doable and will work well in your community. After you consider the results of the study, you can decide whether or not to continue with your co-op idea. If you decide to move forward, you can use the information from the study as the basis of your business plan. Here are the components to include in your feasibility study:

- Preliminary analysis: First, consider if your product will serve the needs of your community. Also, ask if you can successfully compete with other businesses offering the same products or services. Lastly, identify any obstacles that may stand in your way of success. For example, can you acquire the capital needed for your business, or is it unaffordable? The preliminary analysis will illuminate the potential of your idea.

- Market survey: Conduct a market survey or hire an outside company to conduct the survey. Conducting a market survey is a crucial part of your feasibility study. You’ll review factors such as demographics and purchasing power in your community, and you’ll use the information to analyze competitors and potential customers.

You and other members might consider hiring a consultant to assist you with the feasibility analysis. It may be well worth the money to ensure you complete a thorough and accurate study, which can save you a lot of money and effort in the long run.

4. Incorporate and Create Bylaws

If you conclude that your idea is financially feasible, you can take the next steps with confidence. You’ll want to elect a board of directors, incorporate your business and adopt bylaws.

Not all cooperatives are incorporated, but it is important if you want to be legally recognized as a corporation. A corporation is simply the term used to describe a legal entity owned by a group of shareholders. There are many advantages to incorporating, such as:

- Protecting your assets against liabilities

- Allowing you to transfer ownership easily

- Receiving tax advantages

If you decide to incorporate, you’ll need to take the following steps:

- File articles of incorporation with your state: Articles of incorporation are documents you file to legally record the formation of your cooperative. Articles of incorporation include information such as your co-op’s name and address, as well as the names and addresses of the board of directors. The exact document requirements vary by state.

- Write bylaws: Bylaws are the rules of your co-op. The board of directors establishes bylaws during the process of setting up a new company. Creating bylaws will be the step you take after your co-op is legally formed. You do not generally need to file bylaws with your state unless you are applying for nonprofit status. Your bylaws should include information such as the name and address of the business, board member duties, and meeting and record-keeping procedures. Be sure to consult your state’s statutes to help you create bylaws. You might ask a lawyer to ensure your bylaws comply with the laws in your state.

5. Create a Business Plan

After you incorporate and create bylaws, it’s time to develop a detailed business plan. You can think of your business plan as a map that will show members and the board of directors which direction to take to reach common goals. Use the information you gathered from your feasibility study to help you write your business plan.

Overall, your business plan should include everything you and your members need to know to run and grow the co-op. There is no right or wrong way to create a business plan as long as it meets your needs. Traditional business plans include the following:

- An executive summary that includes your mission statement and basic company information.

- A description of the problems your co-op solves and the people it serves.

- A market analysis describing trends in your industry, the outlook, what competitors are doing and how you’ll do it better.

- Information about business layout and management, such as who runs the co-op and how it’s structured.

- A description of the products you sell or services you provide, and how they benefit members.

- How much funding you need, and how you will use it.

6. Obtain Capital

The board of directors will be responsible for acquiring the capital needed to launch the co-op. The good news is that you can explore different financing options for your co-op. Make sure you include how much financing you need and how you plan to obtain it in your business plan.

Membership Shares

The most common way to raise funds for your co-op is by selling shares. Anyone who purchases a membership share automatically becomes an owner in the organization. Their shares afford them voting rights, a share in the profits and a chance to join the board.

Preferred Shares

Selling preferred shares is one of the easiest ways to attract investors without diluting a co-op’s operational principles. Preferred shares, also called investment shares, are ownership sold to investors for a return. These shares don’t afford their holders voting rights or a seat on the board. Their return and other stipulations are included in an agreement between your business and the investor.

Grants

From technical assistance to financing, there are several initiatives from government agencies and foundations designed to help cooperatives grow. You can apply for funding depending on the type of co-op you intend to start.

- United States Department of Agriculture (USDA): The USDA is concerned with the development of rural areas across the country, making it one of the best places to get funding for your co-op. From producer grants to housing and business loans, the USDA’s Rural Development initiative offers a wide range of financial assistance to organizations that foster community development.

- Cooperative Development Foundation (CDF): The primary mission of the CDF, one of our affiliates, is to develop and promote co-ops that improve the economic climate across communities. The foundation provides three types of funding, including the Cooperative Development Fund and the Cooperative Education Fund.

Loans

Another financing avenue to explore includes applying for loans from financial institutions. Institutions like the National Cooperative Bank (NCB) were created to specifically support co-ops. The NCB offers financial solutions for both cooperatives and their members. The bank also partners with Capital Impact Partners to provide catalytic funding for innovative co-ops every year.

Fundraising

You could also try different fundraising strategies to finance your co-op. The benefit of fundraising is that you will not have debt to worry about. You can reach out to your community members or local businesses for financial assistance. Since co-ops are meant to uplift communities, it may be easier to receive donations from locals.

You can also use platforms like Kickstarter or GoFundMe to widen your fundraising efforts. With every fundraising campaign, ensure people understand the impact your co-op will have on the community.

7. Launch

Once you have an adequate amount of capital, you’ll be ready to launch. If your co-op will need employees, this is the perfect time to start hiring. But don’t go on a hiring spree in the early stages of the business — hire strategically. One of the most strategic moves for your co-op can be hiring a successful manager with co-op experience.

If members can be a part of the workforce, ask them to work. You can also hire contractors to help cut costs.

The launch stage is also where you create your marketing plan. Your marketing should lean heavily on your co-op’s difference. The insights you gathered during the ideation and feasibility study are a great resource for creating marketing materials. You can also conduct a marketing audit to strengthen your company’s standing and review how different internal and external factors will affect your business.

Have measurable and time-bound marketing objectives that are specific, achievable and relevant. Everything you publish should convey the fundamental reason for your cooperative’s existence. Open business doors, and celebrate your journey and every accomplishment.

Keys to Successful Cooperative Development

Various key elements will determine the development and success of your cooperative. According to a cooperative development guide put together by the Cooperative Development Institute, the following elements are signs your co-op is off to a good start:

- Founding members are committed and motivated: Your co-op’s members will determine the success of the business. Without your members, the co-op can’t exist. The development of your co-op is more likely to be successful if the members are committed, motivated by your vision, involved in the process from the beginning and will benefit the most from the co-op.

- The project has strong leaders: Every project needs strong leadership to guide members and keep motivation high. If your project has leaders who are strongly interested in the cooperative’s success and willing to contribute their skills, vision and experience, you’ll be heading in the right direction.

- The vision is clear: You have to have a clear vision, so members know what’s expected of them, how to resolve issues and, most importantly, how to achieve goals.

- The business is well-planned: Planning is essential to the success of any business. Make sure you have properly planned all the details of your cooperative and how it will operate. Your plan should include market research.

- It’s financially feasible: You will need adequate capital to succeed. Founding members should be financially committed to the co-op. If you have the financial resources you need from the start, you’ll be able to grow.

Other tips for co-op success include:

- Stay focused

- Keep members up to date and involved

- Set realistic goals

- Use market research, rather than opinions, to guide decisions

- Identify and reduce risks

- Maintain open communication

- Invest in staff training and education

- Raise adequate funding

Join NCBA CLUSA Today

We hope we helped you learn the basics of starting a co-op. Starting any business is a complicated process that demands careful planning and consideration. It also requires the help of other individuals who are as dedicated to your mission as you are. At NCBA CLUSA, we are passionate about promoting the cooperative business model and Building an Inclusive Economy.

If you have questions, we’re here to help. Browse our site to learn more about cooperatives and how we advocate for co-ops around the world, or reach out to us. We would be happy to assist you. If you’re ready to advance, promote and defend cooperative businesses, become a member today.